Medicare Advantage Agent Fundamentals Explained

Table of Contents4 Simple Techniques For Medicare Advantage Agent4 Easy Facts About Medicare Advantage Agent DescribedThe smart Trick of Medicare Advantage Agent That Nobody is DiscussingThe Best Guide To Medicare Advantage AgentThe Only Guide to Medicare Advantage AgentLittle Known Questions About Medicare Advantage Agent.

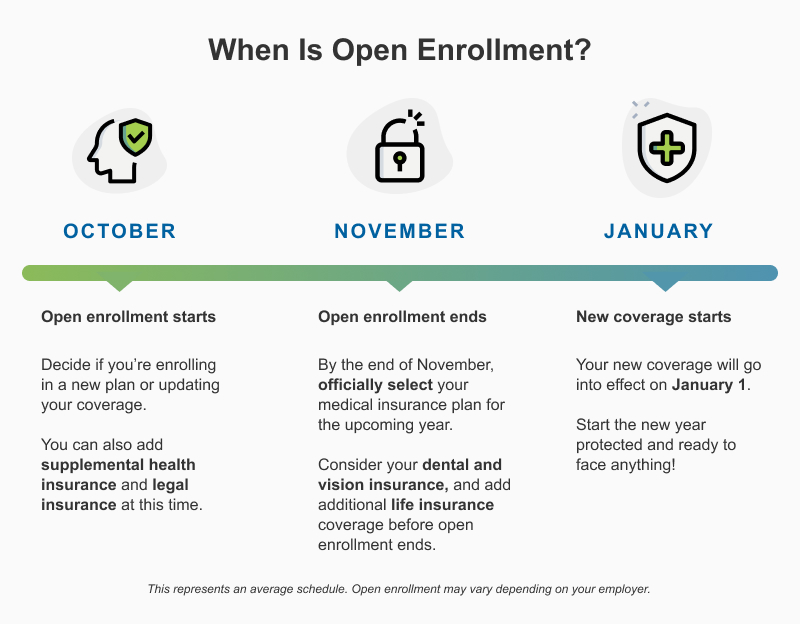

If the anesthesiologist is out of your health plan's network, you will obtain a surprise bill. State and federal regulations safeguard you from surprise clinical bills.You can use this duration to sign up with the plan if you didn't earlier. Strategies with higher deductibles, copayments, and coinsurance have lower premiums.

Know what each strategy covers. If you have physicians you desire to maintain, make certain they're in the strategy's network. Medicare Advantage Agent.

Not known Facts About Medicare Advantage Agent

Make certain your medications are on the strategy's checklist of accepted drugs. A plan will not pay for medications that aren't on its list.

The Texas Life and Health And Wellness Insurance Warranty Association pays claims for health and wellness insurance policy. It does not pay cases for HMOs and some other types of strategies.

Your spouse and kids additionally can continue their protection if you go on Medicare, you and your spouse divorce, or you pass away. They should have gotten on your prepare for one year or be younger than 1 year old. Their protection will certainly finish if they get other protection, don't pay the premiums, or your employer stops offering medical insurance.

Medicare Advantage Agent Things To Know Before You Get This

If you proceed your protection under COBRA, you should pay the premiums yourself. Your COBRA coverage will certainly be the very same as the insurance coverage you had with your company's strategy. Medicare Advantage Agent.

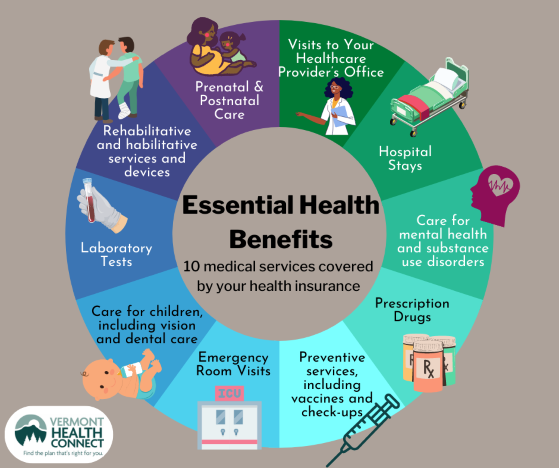

Once you have registered in a health insurance, make sure you understand your strategy and the expense effects of various treatments and services. Going to an out-of-network doctor versus in-network generally costs a consumer much a lot more for the exact same type of solution (Medicare Advantage Agent). When you register you will certainly be offered a certification or proof of protection

Medicare Advantage Agent Can Be Fun For Everyone

It will certainly also tell you if any solutions have constraints (such as maximum my company quantity that the health and wellness plan will certainly pay for durable medical equipment or physical treatment). And it ought to inform what solutions are not covered whatsoever (such as acupuncture). Do your homework, study all the options offered, and assess your insurance coverage before making any decisions.

All about Medicare Advantage Agent

When you have a clinical procedure or see, you generally pay your health and wellness treatment service provider (doctor, health center, my latest blog post therapist, etc) a co-pay, co-insurance, and/or an insurance deductible to cover your portion of the provider's expense. You expect your health and wellness strategy to pay the rest of the expense if you are seeing an in-network provider.

Nonetheless, there are some cases when you may need to sue on your own. This can occur when you go to an out-of-network provider, when the company does not approve your insurance coverage, or he said when you are taking a trip. If you require to submit your own health and wellness insurance coverage claim, call the number on your insurance policy card, and the customer support agent can notify you just how to sue.

Numerous health insurance have a time limit for how long you have to sue, normally within 90 days of the service. After you file the insurance claim, the health insurance has a minimal time (it differs per state) to inform you or your provider if the health plan has accepted or refuted the claim.

Medicare Advantage Agent - Questions

For some health strategies, this medical need decision is made before treatment. For various other health and wellness plans, the choice is made when the business gets an expense from the company.